We recently covered one family who is planning to buy later this year because this family knows sellers tend to become very motivated during the fall and winter months. Shopping the off season is a great way to purchase a home at a nice price, but there are plenty of other ways that you can "buy smart", regardless of the time of year. One of those ways is to research the seller's mortgage prior to making your offer.

Let's suppose you've found the home for you and you're preparing to make your offer. Before you write your offer, you want a better understanding of how much wiggle room the seller has between the list price and the balance on the mortgage. Here's how you do it:

- Go to to the Tapestry Record Search website, a tool for researching recorded real estate documents.

- Click Search Now.

- Select Dane County from the Choose a County drop-down list.

- Enter the seller's first name and last name and click Search.

- Agree to the terms and conditions and click Continue.

- Next, enter your credit card information and submit (the cost for a search is $5.95).

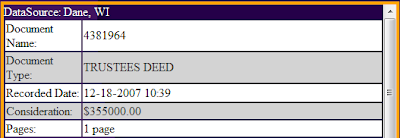

A document summary will appear, something like this:

![]()

The first document in the above list represents a mortgage that has been recorded on the property. Double-clicking this first entry will take you to a summary of the mortgage. You'll see in this particular example the mortgage was recorded on 12/18/2007 for $284,000.

The other document in this example is the Trustees Deed - the deed that was recorded at the time that the property changed hands. From the deed you can see the home was purchased for $355,000.

In this simple example the owners of this home had $71,000 in equity ($355,000 - $284,000) when they purchased their home. This is great information to have prior to a negotiation and very much worth the $5.95 and 5 minutes of time that it takes to produce.

In addition to mortgages and deeds, there are plenty of other documents on Tapestry, including: second mortgages and home equity lines of credit, mortgage satisfactions (i.e. payoffs), liens, and lis pendens filings initiated by banks for properties that may be subject to foreclosure.

If you're working with a buyer agent, your agent can do this research for you. We'll cover other ways that buyers and buyer agents can research properties in our next few posts.

For related information, view our DaneCountyMarket.com article that lists 8 key questions buyers should ask prior to making an offer.

No comments:

Post a Comment