Listing success rates for the Dane County Commercial market were at or above 24% during the first 6 years of the decade. Success rates then decreased over the next 3 years and ended at 14% in the year 2008.

That trend continued in 2009. As of November 30th, the listing success rate over the prior 12 months was 6.8%.

Comparing the success rate to the success rates from other forms of Dane County real estate puts the commercial market in perspective.

* commercial success rate = 6.8%

* multifamily success rate = 19.8%

* condo success rate = 38.3%

* single family home success rate = 57%

For more on the latest commercial real estate trends, you can check out our commercial real estate update on the economic trends page at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Thursday, December 31, 2009

Listing success rates say a lot about the Dane County commercial real estate market

Tuesday, December 29, 2009

The next UW Credit Union home buyer seminar is January 12th

A quick heads up for first-time home buyers in Dane County: The first UW Credit Union Home Buyer Seminar of the new year is scheduled for Tuesday, January 12th from 6:30 to 8:00 PM. The seminar is free and open to the public.

UWCU offers a number of additional seminars covering other financial topics. You can learn more about them here.

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Get the character with the condo in Downtown Madison

The Loraine Condominiums offer a truly unique experience in Downtown Madison. With over 90% of all units sold, several condos across a variety of price ranges are available for purchase, starting at $324,900.

One of the reasons Shawn Kriewaldt and I are excited about our new listing is the history and character of the Loraine building itself:

The Hotel Loraine was originally constructed as a luxury hotel in 1924. More recently the city of Madison designated The Loraine as a national historic landmark due to its history, location, and architectural significance. The Loraine has been renovated for modern times, but take one look at the Grand Lobby and you'll see the hotel's original architecture and character have been wonderfully restored. This video provides a nice view of the Grand Lobby as you enter the front door. This panoramic tour provides another nice glimpse (click the lobby thumbnail image at the bottom of the page to load the lobby tour).

The Loraine offers much more than history and character. Soon we'll share more reasons why The Loraine Condos offer a unique value proposition in Downtown Madison.

Happy Holidays,

Dan Miller, Realtor, Keller Williams Realty and DaneCountyMarket.com

Includes contributions from Brandon Grosse, Realtor/Broker, Accord Realty and TheLoraine.com

Wednesday, December 23, 2009

3 good reasons to start your home search with a mortgage pre-approval

Here are three great reasons to start your home search with a mortgage pre-approval.

- A mortgage pre-approval helps you focus your search on homes that you can afford.

- A pre-approval adds more weight to your offer to purchase, and helps you in the event that other buyers are competing for the same home.

- A pre-approval helps you move through the financing contingency in your offer to purchase more quickly.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Monday, December 21, 2009

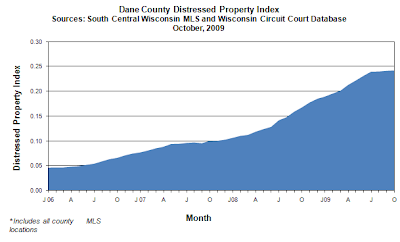

November Dane County Distressed Property Index sits at 24%

Approximately 24% of the home and condo sales in Dane County are related to foreclosure, according to the Distressed Property Index we developed earlier this year. The November index decreased slightly from the index level in October.

The November index decreased because home and condo sales have been increasing at a faster rate than foreclosures. We don't believe this is a start of a long-term trend - and for two reasons. First, the recent rise in home and condo sales is due in large part to the home buyer tax credits. Second, some lenders have been implementing foreclosure moratoriums. Both of these are temporary measures. We expect the index to remain above . 2 for at least the next 6 to 12 months.

Have a good one,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Sunday, December 20, 2009

Thinking of selling? Here's how the latest version of the tax credit affects you.

June is typically the highest volume month for closings in our market. In a "normal" year we would recommend putting your home on the market by March 1st. This date ensures your home gets plenty of exposure to all of the buyers that begin to come out of the woodwork in the late winter and early spring.

However, we have the latest version of the home buyer tax credit in place. This version of the tax credit applies to both first-time home buyers and buyers who sell one home to buy another. The trick is the tax credit can only be claimed by buyers who have an accepted offer by April 30th and close by June 30th.

As we saw in the month of November, the tax credit deadline can have a huge impact on the market. Dane County home and condo sales more than doubled last month - due in large part to first-time home buyers rushing in to beat the previous tax credit deadline of November 30th.

It's impossible to predict the future. But it's very possible all of the recent housing stimulus efforts will end up stealing buyer demand from the future - when interest rates are higher and there are no more stimulus programs in place.

So, if you need to sell, and if you have not already listed your home, we strongly suggest you consider listing during the month of January. And while you're at it make sure your home is aggressively marketed and competitively priced. We don't have a crystal ball, but we do know tax credit deadlines have a tremendous impact on the market. The next four months offer a window of opportunity for buyers and sellers alike.

Have a good Sunday,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Tuesday, December 15, 2009

Now it's easy to find properties for sale in Verona, Middleton, Fitchburg, Sun Prairie and Waunakee

We have 5 newer web sites built off the DaneCountyMarket.com platform which focus on real estate in Verona, Middleton, Fitchburg, Sun Prairie and Waunakee. One of the nice things about each of these sites is it's now very easy to find the local homes and condos for sale in each location.

For example, if you want an easy way to always know the homes and condos for sale in Verona, all you need to do now is go to VeronaRealEstateMarket.com. Here you'll find a SEE ALL VERONA HOMES button and a SEE ALL VERONA CONDOS button.

Both of the above search buttons query the active listings in Verona and display the results in order by price. You can choose to switch the display from ascending to descending to more easily focus on your price range. Here's a sample display for Verona homes.

Both of the above search buttons query the active listings in Verona and display the results in order by price. You can choose to switch the display from ascending to descending to more easily focus on your price range. Here's a sample display for Verona homes.

We'll be adding more useful features to these sites in the near future. In the meantime, please feel free to check out our search tools at any of the following sites:

- http://www.veronarealestatemarket.com/

- http://www.middletonrealestatemarket.com/

- http://www.fitchburgrealestatemarket.com/

- http://www.sunprairierealestatemarket.com/

- http://www.waunakeerealestatemarket.com/

Monday, December 14, 2009

Dane County home and condo sales up 126% in November

Our preliminary statistics from the South Central Wisconsin MLS are in for the month of November, and the headline is not a typo.

Dane County home and condo sales jumped from 212 in November of 2008 to 479 last month, an increase of 126%. November's median price for Dane County homes and condos was $192,000, down from last November's $215,950, a decrease of 10.7%.

The huge increase in sales was due to two factors. First, sales last November plunged after the stock market crashed in September of 2008. Second, many home buyers this November rushed to cash in on the first-time home buyer tax credit that was set to expire on November 30th.

For more details, your can check out our full report at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Friday, December 11, 2009

Multifamily investment term #2: debt service coverage ratio

We recently wrote about net operating income (NOI), which is the cash that remains after accounting for all revenues and expenses related to a property's operations. Note loan payments are not considered operating expenses; they do not contribute to the expenses that are used to determine NOI.

However, loan payments are used to determine a property's debt service coverage ratio (DSCR). The debt service coverage ratio is a ratio that measures the cash that is available after all loan payments are taken into account. In other words:

DSCR = (Net Operating Income)/(Annual Loan Payments)

The debt service coverage ratio is important because in addition to setting a maximum loan to value ratio, most lenders will require a minimum debt service coverage ratio before a loan can be issued.

For example, suppose a lender requires a minimum DSCR of 1.25.

Now suppose the annual net operating income for the subject property is $150,000, and the annual payments for the desired loan are $125,000.

DSCR = ($150,000)/($125,000) = 1.2

In this case the DSCR does not meet the lender's minimum requirements. The financed amount would need to be reduced in order to bring the annual loan payments down and the DSCR up to the lender's minimum standard of 1.25.

Soon we'll cover another important loan constraint - the loan to value ratio.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Wednesday, December 9, 2009

Dane County foreclosures up 24% in November

Foreclosures were up again in Dane County, increasing from 127 in November of 2008 to 157 last month. November marked the 32nd straight month of year-over-year foreclosure increases in Dane County.

For our full foreclosure report, you can check out the economic trends page at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Housing starts sluggish in November

Dane County housing starts were sluggish again in November. A total of 37 housing starts were recorded in November, compared to 35 in November of 2008. The graph below provides a clear picture of how the new construction market has been trending since the beginning of 2005.

Year-to-date, housing starts are down 16.4% compared to the same time period last year.

Thanks to Dominic Collar from MTD Marketing Services of Wisconsin for sharing his data. For more information, you can contact Dominic directly at 920/993-8435. You can also check out our full housing start report on the real estate trends page at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Saturday, December 5, 2009

Dane County months of inventory DECREASE

Dane County home and condo inventory stood at 10.3 months on November 30th, down from 10.8 months on November 30th of 2008. That's the first time inventory has decreased on a year-over-year basis since we started tracking this statistic in 2007.

Inventory for homes only stood at 7.8 months on November 30th, down from 8.2 months a year ago. Condo only inventory stood at 18.7 months, compared to 18.9 months a year ago.

This is an encouraging trend, but keep in mind much of the inventory depletion has been in the lowest price categories due to the implementation of the first-time home buyer tax credit. As you'll see below, inventory varies significantly by price range.

Here's how inventory varies by price range for homes only.

And here's how condo only inventory varies by price range.

Friday, December 4, 2009

Mortgage rates reach all-time lows

If you've been waiting to lock in your rate, the time to act is now.

Thursday, December 3, 2009

UW Credit Union offering $500 off closing costs through April 30th

UW Credit Union is offering $500 off closing costs through April 30th.

In case you missed it, UWCU recently joined our DaneCountyMarket.com web site. Now our web site users can research the market, search for properties, monitor interest rates, and apply for a loan all from one online location.

UWCU will be contributing a number of educational articles to our site in the very near feature. Needless to say we're ecstatic to have UWCU joining DaneCountyMarket.com, making it an even better resource for the consumer seeking comprehensive and reliable real estate information - without any strings.

Have a great day,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Wednesday, December 2, 2009

Dane County multifamily sales down in October

Only 8 Dane County multifamily listings totaling 21 units sold via the South Central Wisconsin MLS in October. As you'll see below, the demand for multifamily real estate has decreased significantly in the last year.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Tuesday, December 1, 2009

Dane County commercial real estate sales still decreasing

While sales for Dane County homes and condos have been on the rise due to the homebuyer tax credit, commercial real estate sales in Dane County have fallen dramatically.

Just over $10.1 million in commercial real estate sold via the MLS during the 12 month period that ended on October 31st, compared to $28.1 million from the previous 12 months. That's a decrease of 64%.

Most recently, zero sales occurred via the MLS in September. Two sales totaling $205,000 occurred during the month of October.

For more on the latest commercial real estate trends, visit our commercial real estate update on the economic trends page at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Sunday, November 29, 2009

Multifamily investment term #1: net operating income

We've covered how the Dane County multifamily real estate market has changed, presenting investors with new opportunities that weren't available a few years ago. Due to this clear market shift, we've created a new web site, MadisonIncomeProperties.com, which we've designed to help Dane County investors with their multifamily real estate goals. We'll be adding more content to our site over the next several weeks, including a multifamily real estate search tool, so please check back often as we round out our site.

One of the tools we'll be adding soon is a glossary of investments terms, and we'll begin by covering these terms one-by-one in our blog. The first investment term that we'll cover is net operating income.

The net operating income (NOI) is the cash flow that remains after a property's operating expenses are subtracted from operating income. NOI is an important investment concept, as it's used as the basis for several other key investment calculations.

Net Operating Income = Operating Income - Operating Expenses

Operating income is the income that results from monthly rents, parking fees, laundry income, parking fees, etc.

Operating expenses are those expenses that are related to the operation of the property, such as taxes, utilities, insurance, maintenance, management fees, payroll and administrative expenses. Note loan payments, amortization and appreciation are not considered operating expenses.

Many times sellers of multifamily real estate publish the net operating income associated with a particular property. As an investor, it's important to know the details behind this number. Specifically:

- Are are all operating expenses realistically accounted for in the calculation?

- Is the operating income based on the ideal scenario with a vacancy rate equal to zero? Or is it based on historical performance which accounts for the actual vacancy rate?

Stay tuned. We'll be covering several other key multifamily real estate terms in the near future.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Saturday, November 28, 2009

How some investors are using their cash

We recently wrote about 4 brothers who are using their cash to invest in multifamily real estate - a long term approach to real estate investing. Other investors are using their cash in a different way.

We're working with one local investor group that has amassed a large sum of money for short-term real estate investment. The investor group uses its cash to buy distressed properties, which are then rehabbed and sold for a profit. Because this group pays cash for its investments, it can close on a property in a matter of a few days once an offer is accepted. This makes this buyer a good fit for the distressed property owner who needs to unload a property quickly - and without any worry of the deal falling apart due to a financing or inspection contingency.

We're also talking to an out of state investor group about its goals. This group has successfully implemented an investing system in several different markets around the country. In each market, the group uses its cash to buy 3 to 10 properties a month. Similar to above, these properties are rehabbed and then sold for a profit.

The advantage of the buy, fix and flip approach mentioned above is the investor receives a return on his investment in a matter of just a few months. In fact the investor can re-invest his money several times throughout the year for a very nice profit.

The disadvantage is there is more risk. These investors mitigate their risk by having clear standards. They focus on starter homes, where there is a relatively strong demand for the supply that is on the market. They "buy right" (ie at a good price), which gives them some cushion in case something unexpected pops up during the rehab process. They also develop detailed and realistic plans around the acquisition, rehab and resale of their investments, so they can reasonably estimate their returns.

We expect to see more and more short-term investors due to the growing number of foreclosures in Dane County. Even when foreclosures start to subside, distressed properties will continue to play a large role in the market for years to come. Keep in mind foreclosure levels right now are several times higher than they were just a few years ago. Also, it typically takes 6 to 18 months for a foreclosed home to work its way onto the open market. The irony is the number of distressed properties will continue to increase even as the number of foreclosure filings begins to subside.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Friday, November 27, 2009

Upcoming Madison first-time home buyer seminars

The home buyer tax credit has been extended and enhanced, but in order to take advantage of the credit you must have your offer accepted by April 30th 2010 and your home closed by June 30th 2010. The deadline is not far away considering all of the steps that go into buying a home.

If you're new to the home buying process, you should consider attending one of the upcoming UW Credit Union or Dane County Housing Authority seminars. Both are no-nonsense seminars that provide a good introduction to the lending, inspection and purchasing pieces of the home buying process. With a little education under your belt, you will have the knowledge you need to go about your purchase in a thorough and efficient manner - and meet the deadline for the tax credit.

The next UW Credit Union Seminar is Tuesday, January 12th from 6:30 to 8:00 PM.

The next Dane County Housing Authority seminar is a two-part series with sessions on both Tuesday, December 1st and Tuesday, December 8th. Both sessions run from 6:00 to 9:00 PM. Click here for more course details and registration info.

Have a great weekend,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Two distressed properties, and many more on the way

We recently wrote about two duplexes that are worth a look from investors who are seeking to cash flow multifamily properties. Below are two other intriguing properties, one a home and the other a condo.

This 3 bedroom home at 125 N. 5th Street in Madison is priced at $94,900 and almost $60,000 under assessment.

This large 3 bedroom condo at 619 Wood Violet Lane in Sun Prairie is priced at $110,000 and over $69,000 under assessment.

Both of these properties are lender-owned. And both require some work, so they're a good fit for someone who is willing to invest some sweat equity in order to improve the value of their investment.

There are plenty of properties like these on the market right now. And there will be plenty more coming down the pike as more and more foreclosures work their way through the system and onto the open market.

One of the ways we learn about properties like these is by implementing a key word search of the MLS which sends us an email whenever a listing with one of the key words hits the market (or when an existing listing with a key word match undergoes a price reduction). For example, we have this search currently set up for an investor:

"forecl*, *as is*, *bank*, *corp*, *fixer*, *flip*, *investor*, *lend*, *lien*, *reo*, *short sale*, *subj*,* tlc*"

We'll discuss how this investor is leveraging the market in a future post.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Wednesday, November 25, 2009

Good deals in a buyer's market (two ways to find them)

A few days ago we downloaded from the South Central Wisconsin MLS all of the email addresses for agents with a single family home listing in Dane County. This amounted to almost 1,000 email addresses. Then we sent an email on behalf of an investor letting these agents know what our investor is looking for.

We've received a ton of responses, and they are still coming in. Most of the properties that we have learned about don't fit this investor's needs, but there are a few in our list that we will be looking at more closely.

There are two advantages to the mass email approach that are worth noting. First, for some properties we receive a lot of information that isn't available from the online listing. In some cases the client has given the listing agent permission to share his level of motivation, or the client has given his agent permission to share how low he is willing to go with price. Another nice advantage is we now have a large network of agents that is keeping us in mind as other properties become available in the future.

Over the next several weeks we'll share some properties that show some promise for the buyer that is looking for a good deal. And today we'll start with two duplexes located at 3010-3012 and 3014-3016 Union Street on Madison's East Side. Both buildings are listed at $117,000 with rents on each unit at $600 and higher. Run some numbers on these properties and you'll see they look pretty good, pretty quick. Also keep in mind if you plan to owner occupy a duplex, you could be eligible for the enhanced tax credit.

We learned about these two properties because we have an automated search set up that sends us an email anytime a new multifamily listing enters the Dane County market, as well as anytime an existing listing undergoes a price change. These two properties recently underwent huge price reductions, which is why we're sharing them with you right now.

Have a happy and safe holiday,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Tuesday, November 24, 2009

Strangely enough we're assisting two different pairs of brothers with their investment plans right now.

Pair #1 already owns 2 duplexes and is in the process of expanding its portfolio. Last week these two brothers put in an offer on an 8-unit, and we're waiting to see how this one turns out.

Pair #2 is new to the game. These two brothers are looking to buy their first duplex using the money they have saved between the two of them.

Both sets of brothers are at different points in their investment plans, but they are similar in many ways. They are all planners and goal-setters, and they all believe in the "get rich slow" formula that multifamily real estate offers. All of these brothers are seeking a property that cash flows while they pay down their mortgage and their property appreciates in value over time. They are aware of the tax benefits that come with multifamily real estate, and they plan to leverage their equity in future years to buy additional properties.

Both sets of brothers are persistent and patient. They have clear standards, and they are willing to evaluate 30 properties in order to find the one property that meets their criteria.

As we've stated before, it's a buyer's market in multifamily real estate. The irony is not many people are buying. Here's our latest multifamily real estate report. You'll find more useful information at MadisonIncomeProperties.com, including how we help you buy and how we help you sell multifamily real estate.

Have a good day,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Sunday, November 22, 2009

Video tours are a great idea for some listings

We're starting to use professional home video tours for our listings because the quality of the product offered by Whirligig Online Marketing is excellent. Video tours are a great fit for homes with quality upgrades and professional staging. They give buyers a closer look at what each listing has to offer. Because of this, we're happy to invest in professional tours as part of our marketing plan.

For example, take a look at the video tours for these 3 new listings (click the "video" tab along the top menu).

- 1714 Bellewood Drive, 5 BR/4.5 BA, Waunakee Parade Home - $995,000

- 1407 Blue Ridge Trail, 4 BR/4.5 BA, Waunakee Parade Home - $765,000

- 3317 Westview Lane, 3 BR/2.75 BA, Madison Arbor Hills - $299,000

For a list of over 25 marketing ideas, check out our online marketing plan. You can view it here on the how we help you page at DaneCountyMarket.com.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

An overview of the enhanced home buyer tax credit

The $8,000 first-time home buyer tax credit has been extended into the year 2010, and now "long-time" home owners who sell one home and buy another are eligible for a $6,500 tax credit. A long-time home owner is defined as someone who has owned and occupied a home as a primary residence for at least 5 consecutive years out of the previous 8 years.

Tax payers who plan to claim the credit need to have a binding contract by April 30th 2010, and must close on their property by June 30th 2010.

If you're planning to take advantage of the tax credit, we recommend you plan on making your offer by April 1st. In case your offer does not get accepted, you'll want to allow yourself some time to find another property that meets your needs. And don't forget right now is a great time to shop for a home. Buyer traffic is lower right now than at any other time during the sales year. That means less competition from other buyers and more leverage with sellers.

For more information on the enhanced tax credit, you can check out this article on the buying real estate page at DaneCountyMarket.com.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Thursday, November 19, 2009

Dane County distressed property sales on the rise

The Dane County Distressed Property Index rose slightly in October to .24, indicating approximately 24% of the home and condos sales in October were related to foreclosure. The chart below shows the index has quadrupled since January of 2006.

On a related note, the Mortgage Bankers Association announced today in its National Delinquency Survey that 14.41% of all loans were either in foreclosure or at least one payment past due at the end of the third quarter 2009. That's a new record.

With a rising number of distressed properties and lower prices, we're seeing a lot of interest from buyers who might not otherwise be in the market. This includes home shoppers, and investors, too. In the last several months we've met multiple buyers who have been saving their cash for the right moment to jump in. And many of them are jumping in right now.

Soon we'll share some stories of different buyers and how they are leveraging the market.

Have a good Friday,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

UW Credit Union has joined the DaneCountyMarket.com web site

We're excited to announce the UW Credit Union has joined our DaneCountyMarket.com web site. This means our web site users can now search for properties, research the market, check the latest mortgage rates, and apply for a loan all from one convenient online location.

Speaking of mortgage rates, loans for 30 year fixed rate mortgages were available for 4.75% yesterday. You can check out today's rates by going to our home page.

Like us, UWCU is a provider of good consumer information, and soon UWCU will be offering educational articles that will be available from our site.

Have a great day,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Monday, November 16, 2009

Dane County home and condo sales up again October

Our preliminary statistics from the South Central Wisconsin MLS are in for the month of October.

Friday, November 13, 2009

Five Northern Bay Condos up for auction on Saturday, December 12th

Five of the Northern Bay Condos on Castle Rock Lake will be put up for auction by Micoley & Company on Saturday, December 12th, at 11:00 AM. Registration for the event starts at 10:00 AM. The minimum acceptable bid will be $95,000 or $125,000, depending on the unit. For more information on the auction, you can check out this link from Micoley & Company.

Lately we've seen a number of condo developments getting serious about moving their inventory, either through public auctions or dramatic price reductions. Condo inventory remains very high. Don't be surprised if we see additional fire sales in the coming months.

Have a good weekend,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Wednesday, November 11, 2009

Dane County housing starts sluggish in October

We're almost ready to publish our Dane County existing home sales data for the month of October. October will mark the fourth straight month of increasing house sales (and the second straight month for condos). Clearly the home buyer tax credit is having an effect on the sale of existing homes and condos, especially in the lower end of the market.

However, Dane County housing starts remain sluggish. A total of 49 housing starts were recorded in October, compared to 52 in October of 2008, a decrease of 5.8%. Here's the monthly trend dating back to January of 2005.

Year-to-date, housing starts are down 17.6% compared to the same time period last year.

We do expect housing starts to gain some momentum with the implementation of the enhanced home buyer tax credit. We'll have more info about the credit soon.

Thanks to Dominic Collar from MTD Marketing Services of Wisconsin for sharing his data. For more information, you can contact Dominic directly at 920/993-8435. You can also check out our full housing start report on the real estate trends page at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Tuesday, November 10, 2009

154 Dane County foreclosure filings in October

A total of 154 Dane County foreclosures were filed in October, up 1.3% from the 152 foreclosures filed in October of 2008. Although only up slightly from last year's total, this October's number represents the third highest monthly total dating back to October of 2008.

For our full foreclosure report, you can check out the economic trends page at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Thursday, November 5, 2009

You're buying a new home. Should you work with the listing agent? A buyer agent? An attorney?

We recently showed in this post why working with a good buyer agent can be a huge benefit to a home buyer. A listing agent can't provide you with the level of service and advocacy that you should expect from an agent in today's market. Remember, the listing agent works for her client, the seller. So when it comes to choosing between working with the listing agent and a good buyer agent, a good buyer agent is the clear choice.

But what about an attorney? We fully support any buyer who wishes to hire an attorney. An attorney provides peace of mind. She brings a different skill set to the table and helps to make sure that you, the buyer, are protected from all angles. A good attorney can be tremendously helpful during the home buying process.

Should working with an attorney preclude you from working with a buyer agent as well? We don't think so. But that is the perception held by more than a few people. Some folks believe the buyer agent and the listing agent will always be in cahoots, that both agents will conspire to ensure "the deal goes through". That's not part of our game.

Our firm belief is that if you decide to hire an attorney, you should have a good buyer agent assist you as well. It should be a team effort. And here are 3 big reasons why.

1) A good buyer agent brings market expertise to the table. The market is changing every day, and the market is not an attorney's focus. I go back to this post. Could most attorneys deliver the level of market expertise that this buyer received from his agent? I don't think so.

2) A good buyer agent is available to assist his client throughout the entire transaction, including the home inspection and final walk through. As a consumer making the biggest purchase of your life, don't you want someone to be by your side when your inspection takes place? You should. If issues arise during your inspection (as they often do), your buyer agent is a great resource to help you strategize your next steps - because your agent was at your side during the inspection and saw the same things you did. And what about the final walk through just prior to closing? Would you rather be joined by the listing agent (who represents the seller) or a buyer agent (who represents you)?

3) A buyer agent costs you nothing. And a good buyer agent is with you for the long haul. These days our buyer clients average about 2.5 offers per closing. That means our typical buyer is making 2 or 3 offers before he successfully closes on his home. Every time we go to bat for our clients, the cost is the same - nothing.

We think working with a good buyer agent is a no-brainer, but it's important to find someone you can trust. We'll provide some tips for finding a good buyer agent in a future post.

For more information on buyer representation and how the buyer agency agreement works, you can check out this link at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Wednesday, November 4, 2009

A very cool home inspection web site

Home inspector Brian Paull from Premier Inspection & Consulting has a very useful web site for anyone who is interested in learning more about home maintenance and the home inspection process. Brian's site includes a description of the home inspection standards of practice and a section on frequently asked questions, as well as information on radon, mold, and many other topics such as energy efficiency, electrical safety, asbestos, child safety, elderly safety and more.

For more useful inspection and testing information, you can check out the inspection and testing resource page under buying real estate at DaneCountyMarket.com.

Have a good day,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Tuesday, November 3, 2009

Dane County multifamily inventory still climbing

As of October 31st the months of inventory for Dane County multifamily real estate stood at 41.9 months. That's more than twice the inventory for Dane County condos, and almost 5 times the inventory for Dane County homes.

With high inventory and low sales, it's a great time to learn about multifamily real estate. Some sellers are becoming more flexible with pricing, and we're seeing more and more multifamily foreclosures.

If you're interested in learning more about multifamily real estate, please feel free to join us for our FREE workshop at 6PM on Tuesday, November 17th, at Bishop's Bay Country Club.

In the meantime, here is some additional useful information: You'll find our latest multifamily real estate report here, and information on how we assist our investor clients here. We've also launched a new web site - www.MadisonIncomeProperties.com - that makes it easy to find all of our information on multifamily investing. We'll be adding more useful content soon.

Have a great Tuesday,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Thursday, October 29, 2009

Changes on the horizon for the tax credit?

It's beginning to look like the $8,000 tax credit for first-time home buyers will be extended, AND the tax credit may be enhanced to include individuals who sell a home to buy another. This article provides more details.

Speaking of buying, two local home buyer seminars are on the calendar for November.

The UW Credit Union is offering a seminar on Tuesday, November 10th from 6:30 to 8:00 PM. For more information about this seminar, click here.

The Dane County Housing Authority is sponsoring a two-part series with seminars on both Tuesday, November 10th and Tuesday, November 17th. Both sessions run from 6:00 to 9:00 PM. For course details and registration info, click here.

We'll be sharing more info on the tax credit extension if and when it occurs.

Have a great Friday,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Multifamily investment workshop is set for Tuesday, November 17th at 6 PM

We're excited to be holding a free real estate investment workshop at 6:00 PM on Tuesday, November 17th at Bishops Bay Country Club. The atmosphere will be very casual, and appetizers and refreshments will be provided. There's no need to worry about any heavy pressure or sales spin. That's not what we do. The workshop will last as long as needed in order to make sure we address everyone's interests and questions.

Our focus will be on passive income and multifamily real estate. Our panel will include Jim Hill and Shawn Kriewaldt from Keller Williams Realty. We'll also have a lender, an attorney and an accountant on hand - all of whom are experienced with multifamily real estate.

This is a great opportunity for anyone with an interest in multifamily real estate to ask questions about the market and property acquisition strategies, as well as lending, legal, financial and other topics. Rookies and experienced investors alike are invited to attend.

If you'd like to attend, please contact us at MadisonIncomeProperties.com. And while you're at it, please let us know what issues you'd like to discuss. We want to make sure the workshop addresses your needs.

Have a great weekend,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Wednesday, October 28, 2009

Looking for a good deal? Work with a good buyer agent.

We have a client who just closed on his condo last week. Several weeks ago he determined this property would fit his needs, and he asked us to represent him during the negotiation process. One of his main goals was to purchase the condo at a very good price.

We started by researching the condo market in the neighborhood and within the condo development itself. Our review of recent MLS transactions showed this condo was already competitively priced.

Next, we looked at the condo's listing and sales history. This condo had been on the market for 22 months. During that time it had undergone 3 price reductions, with the most recent reduction dropping the price $57,000 below the orginal list.

Then we researched the mortgage and checked for other liens on the property. We found there was still plenty of equity left in the condo even though it would end up selling for well below the seller's original purchase price.

Last, we looked for evidence of delinquent property taxes and evidence of foreclosure. We didn't find any issues on either front.

Now we were ready to draft the offer to purchase. We drafted the offer, and along with that we submitted a cover letter. The cover letter outlined the justification for the price. We included recent sales data from the condo development, and we cited data from the MLS which showed a very strong trend toward lower condo prices. We stated in the letter that the offer price was not only based on recent sales data, but the overall direction of the market.

In our letter we acknowledged the offer price was well below what the seller was hoping to receive, but we politely stated the price was non-negotiable. We thanked the sellers in advance for their consideration, and we awaited their response.

Two days later the sellers signed the offer. The buyer's inspection went well and we proceeded smoothly to closing. As it turned out the sellers did not like our tactics and decided they did not want to sit with us at the closing table. They completed their closing paperwork several days prior to the buyers.

I sympathize with the sellers and understand why they were unhappy with the results of their sale. It was a bitter pill to swallow. But our job was to advance our client's goals and protect his best interests. And as it turned out, our strategy worked. It's also worth mentioning that although the buyer hired us to represent him for his purchase, it was the sellers who paid our commission.

For more information on buyer representation and how the buyer agency agreement works, you can check out this link on DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Monday, October 26, 2009

Cold Play

As we approach the month of November, the weather becomes colder - and the real estate market does, too. It may sound counter-intuitive, but the next few months offer an excellent opportunity to buy real estate. And for a few reasons:

#1: Although inventory is lower now than it is in the Spring and Summer months, it is still quite high by historical standards. .

#2: Buyer demand drops significantly in the Fall and Winter months. This means less competition from other buyers and more flexibility from sellers. Many sellers become very flexible with pricing after they've seen their home sit on the market through the Spring and Summer months.

#3: News of higher unemployment and higher foreclosure rates affects the psyche of many sellers, causing some to do whatever it takes to get their home sold.

#4: Interest rates are at historic lows. And there's no guarantee that they'll be this low next year.

A good buyer agent can be a tremendous asset for the individual who wants an excellent deal - and someone to advocate his best interests throughout his transaction. In our next post we'll share an example of how we assisted a buyer client who just closed on his new condo.

Have a good day,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Wednesday, October 21, 2009

Do you know someone who is worried about foreclosure?

This web site - DaneCountyShortSales.com - has a list of useful resources. It also includes basic information about the short sale process, as well as information on how we've structured our real estate team to assist our short sale clients.

You won't find any heavy spin on the site. We've done our best to lay out the information in a concise and straight forward matter. Also, we don't force users of our site to give up their contact info in order to view our information.

Have a good day,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Monday, October 19, 2009

Plenty of buying opportunities on the horizon in Dane County

Approximately 24% of the home and condo sales in Dane County are related to foreclosure. This is according to a new measure - the distressed property index - that we've developed along with Peter Zarov from Homestead Title. The graph below shows how the index has grown by almost 5 times since January of 2006.

Thursday, October 15, 2009

Dane County home and condo sales up big in September

Dane County home sales rose on a year-over-year basis for the third straight month. Home sales last month increased by 19% from last September. Meanwhile Dane County condo sales rose for the first month since October of 2007. Condo sales last month were up 33% from the number of condos sold in September of 2008.

The median Dane County home price decreased by 1.9% in September. The median Dane County condo price decreased by 13.5%, as much of the condo buying activity was in the most affordable price categories.

The first-time home buyer tax credit is certainly spurring sales. In the home market, we're also sensing more interest from move-up buyers seeking larger and more expensive properties.

For more details, your can check our our full report at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Tuesday, October 13, 2009

How does Dane County compare to other area markets?

We pay a lot of attention to the Dane County real estate market. When we take a look at the data for other surrounding counties it becomes abundantly clear how good the Dane County market is compared to other local markets.

Take a look at this graph, which shows the single family home months of inventory for 9 local counties.

The months of inventory in Dane County are much less than the levels for any of the other counties in the South Central Wisconsin MLS. Dane County is not immune to national economic trends, but all-in-all it is a great place to be practicing real estate.

For more information on how inventory varies by location, you can check out this report.

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Friday, October 9, 2009

Dane County foreclosures set a record in September

Dane County foreclosures jumped from 101 in September of 2008 to 184 last month - an increase of 82%. The 184 foreclosures last month set a new record for Dane County. Here's how foreclosures have been trending since January of 2005.

Thursday, October 8, 2009

Dane County housing starts lower in September

Dane County housing starts totaled 48 in September, down by more than 22% from the 62 housing starts in September of 2008. The chart below shows how monthly housing starts have been trending since January of 2005.

The peak September for housing starts over the last decade was in 2003 (not in chart), when 239 housing starts were initiated. The 48 starts this past month were 80% off the peak.

Tuesday, October 6, 2009

Does your listing look great online and in person?

Over ninety percent of home buyers use the internet to find their home. And in many cases it's the online photos that either help a home "make the cut" or "get cut" from a buyer's list.

That's why we hire an interior designer to assist all of our clients with the staging of their home. Then we bring in a professional photographer to take the photos and create the virtual tour that will be posted to the internet.

Take a look at the three homes below. All of these homes look great in person, but just as important they look great online, too.

Fitchburg, Swan Creek, 4 BR/3BA, $299,900+

Verona, Westridge, 3 BR/2.5 BA, $299,900