A number of Realtors, including our real estate team, are investing in a relatively new and very cool tool that allows friends and customers to easily track the market in their location of choice. Users receive a monthly update that includes information on current listings, as well as listing details for properties that have recently sold.

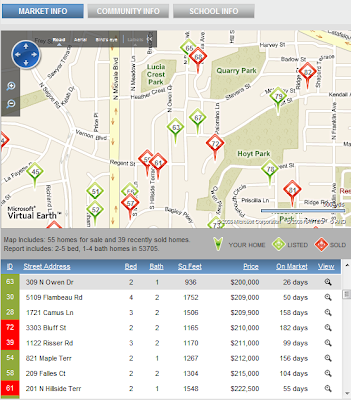

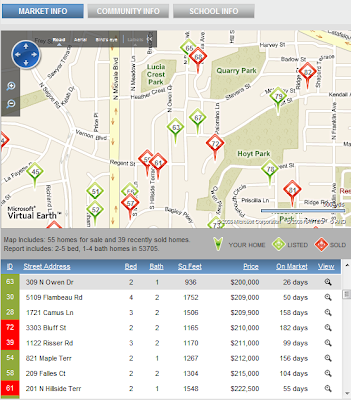

Here's a sample view of the tool. Each green property represents an active listing. Each red property represents a listing that has recently sold.

From this birds eye view you can choose to learn more about any of the properties in the list. Additional details include a property description, list of amenities, MLS ID and photo.

This tool is especially handy for people, such as relocating buyers, who want to learn more about a particular neighborhood. In addition to the market information mentioned above, the tool provides a map that displays information on area schools, parks, places of worship, restaurants and shops, entertainment venues, and other neighborhood features.

Talk to your Realtor if you feel this tool would be beneficial to you. Or you can check out this brief article on DaneCountyMarket.com. It tells you more about the tool and how it can be customized to match your interests. The tool is easy-to-use and free of charge.

We'll keep you posted in 2009. You'll find our

We'll keep you posted in 2009. You'll find our  The graph also shows how inventory varies with the seasons. Take a look at last year. Home and condo inventory grew by 1,070 units from 12/31/2007 to 4/30/2008 as many sellers listed their properties in time for the peak buying season.

The graph also shows how inventory varies with the seasons. Take a look at last year. Home and condo inventory grew by 1,070 units from 12/31/2007 to 4/30/2008 as many sellers listed their properties in time for the peak buying season.