Buyer activity in the multifamily market was light in July, when 14 Dane County listings totaling 40 units sold via the South Central Wisconsin MLS.

Meanwhile August 31st inventory climbed to over 39 months.

You'll find our full multifamily market report on the economic trends page at DaneCountyMarket.com .

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Monday, August 31, 2009

Dane County multifamily real estate update: sales low, inventory high

Sunday, August 30, 2009

Short sales: qualifying reasons for financial hardship

In our last post we defined a short sale. In order to qualify for a short sale, a home owner must be able to demonstrate one or more of the following:

- financial hardship,

- negative cash flow, where monthly expenses exceed monthly income, or

- evidence of pending loss and insolvency

The most common justification for a short sale is financial hardship.

And by far and away the number one reason used to justify financial hardship is a mortgage adjustment or loan payment increase.

Other qualifying hardhip reasons include the following:

- Separation or divorce

- Job loss

- Reduced income

- Excessive debt

- Death of a spouse or family member

- Severe illness

- Involuntary job relocation

- Business failure (for the small business owner)

- Damage to property

- Inheritance (for heirs receiving ownership of property)

- Military service

- Tax or insurance increase

- Incarceration

When you sell your home as a short sale, one of the things you will need to do is write a hardship letter to your lender. We recommend you keep the letter to a single page.

We'll cover this and other aspects of the short sale process in the near future.

Have a good day,

Dan Miller, Realtor, Certified Distressed Property Expert, Keller Williams Realty and DaneCountyMarket.com

Saturday, August 29, 2009

What is a short sale?

An owner "is short" on his property when the amount he owes on his mortgage, combined with commission and closing costs, is higher than the current market value of the property.

A "short sale" occurs when a negotiation is entered into with the property owner's mortgage company (or companies) to accept less than the full balance of the loan(s) at closing.

A short sale is the preferred solution for many home owners facing foreclosure. That's because among other things a foreclosure can have a large and lasting impact on a person's credit score, credit history, and job status. More on this topic will be coming soon.

In order to qualify for a short sale, a home owner must be able to demonstrate one or more of the following:

- financial hardship

- negative cash flow where monthly expenses exceed monthly income, or

- evidence of pending loss and insolvency

The most common justification for a short sale is an increase in monthly mortgage payments. We'll cover this and other acceptable forms of financial hardship in our next post.

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Friday, August 28, 2009

Why distressed property sales are more than a short-term trend

Even in Dane County, a stable market compared to most others, distressed property sales are a common occurrence. According to Homestead Title's Peter Zarov, 27% of that title company's closings from December 2008 through May 2009 were for distressed properties. In 2006 and prior years distressed sales made up only 2% of closings.

We're expecting distressed property sales to rise for the foreseeable future, and for a number of reasons:

Mortgage delinquencies continue to rise to record levels, according to the Mortgage Bankers Association.

Dane County foreclosures are rising at a rapid pace.

Local unemployment is also increasing.

Meanwhile local prices are decreasing.

Many of the people who need to sell are those who bought their home within the last 5 years, with no or relatively little money down. The end result is a recipe for short sales and bank-owned properties.

We'll be devoting a lot of time to the distressed property market, in particular short sales, in the coming weeks. Plenty more to follow.

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Wednesday, August 26, 2009

"How can I trust you'll serve my best interest when you get paid by commission?"

We tend to get this question at first-time home buyer seminars when we talk about the benefits of buyer agency.

And it's a really good question.

The truth is the trust has to be earned. But the responsibility starts with you, the buyer, to interview your agent and ask the questions that matter most to you. And while you're at it why not check his references?

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Tuesday, August 25, 2009

Three ways to surface good investment deals

Many multifamily listings just don't add up for the buyer who is looking to cash flow a property. The listed price is too high, and the rents are too low, to make money on a monthly basis. Finding the right property can require some persistence and patience.

With this in mind, here are 3 ways to find a multifamily owner who is willing to sell at a price that makes sense for you, the buyer.

Ask your Realtor to send an email to the listing agents of other multifamily properties. Your Realtor's email should state he has a client who is ready to buy a property that makes economic sense for his client. Your Realtor will receive a lot of replies. Some of those replies will state that the seller is motivated and willing to entertain any offer.

Get out and tour some properties, even those that are currently listed at prices too high to justify a purchase. This is a good idea for two reasons. First, it allows you to stay in touch with the inventory on the market. Second, some of these sellers will eventually become more flexible. You'll find they will reach out to you when they are ready to lower their price.

Have your Realtor monitor the market for new listings and price reductions that make sense for you, the buyer. As an example, we have a client that had his eye on a property for several weeks. Then the price was dropped by $50,000. This represented a great opportunity for our client, and we immediately submitted an offer. Two other offers came in at the same time. Our client's offer was not for the highest price, but the seller chose to go with our client because he was pre-approved and could close quickly.

There are plenty of opportunities out in the market right now, and there will be plenty more in the future. The investors who cash in on these opportunities will be the ones that are patient, persistent and ready to pounce when the right opportunity presents itself.

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Monday, August 24, 2009

Many opportunities on the horizon for buy and hold investors

July was a record month for Dane County foreclosures, and August is shaping up to be another big month for new filings. Many of the recent foreclosure filings have been for multifamily properties. We're expecting to see more and more bank-owned multifamily properties hitting the market in the coming months - and some very good opportunities for those seeking to invest in buy and hold real estate.

In the near future we'll be organizing some informal sessions for anyone who has an interest in investing in multifamily real estate. We'll cover financing, legal issues, property management, the latest market trends, and strategies for finding and evaluating properties. We'll share some spreadsheet tools that make it easy to evaluate the economics of individual properties. Most of our time will be spent in the form of questions and answers, so you have time to address the items that are important to you. We plan to have a seasoned investor, a lender who specializes in investment loans, an attorney, and several real estate agents available to address your questions. These won't be high pressure sales seminars. Just an opportunity to share ideas and learn. We'll share more information about the Q&A sessions in the next few weeks. In the meantime, if you would like to start learning more about how you can get started in buy and hold investing, feel free to contact us. We'll be happy to meet with you and help you start moving forward in the right direction.

For related articles, check out our multifamily real state update and our monthly foreclosure update. You'll find both on the economic trends page at DaneCountyMarket.com.

Have a good Monday,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Friday, August 21, 2009

Please fund the Dane County Housing Authority first-time home buyer program

To the Community Development Block Grant Commission:

I'm concerned by the commission's recommendation to cease funding of the Dane County Housing Authority (DCHA) first-time home buyer seminars - for several reasons.

First, the seminars offer a no-nonsense education that is difficult to find anywhere else. As a participant in several previous seminars I've seen how volunteers from the real estate, lending, insurance and home inspection fields work together to educate community members on the home buying and home ownership process. Buying a home can be an overwhelming process, especially for the first-time home buyer. The DCHA seminars provide community members with a solid foundation for responsible home ownership. At a time when Dane County foreclosures are at an all-time high, it's the wrong time to be cutting this program.

Second, the classes educate community members on how they can apply for funds that make home ownership more accessible to people with limited financial means. These public funding programs aim to increase the levels of home ownership for the middle and lower middle classes. Eliminating the DCHA seminars directly contradicts this goal.

Third, the demand for these classes is huge. I've participated in two classes this year where 40 people were in attendance. People from all over the county and from a variety of backgrounds who spent six hours together learning about and discussing the path to home ownership. A DCHA seminar is a true community and multicultural event.

Last, the DCHA seminars give back to the community by promoting fiscally responsible home ownership. Dane County has a large inventory of unsold and vacant homes. The DCHA seminars help to fill these homes with new owners who are financially ready and personally very eager for the dream of home ownership. The graduates of the DCHA program help to solidify communities and shore up the tax base. Think of this from a financial perspective alone. Hundreds of people graduate from this program each year, but the program pays for itself after only a small percentage of the graduates enter the world of home ownership. All of the new home owners from this program pay property taxes. At a time when local revenues are lagging, isn't this one of our most pressing community needs?

Times are tough and there are many deserving programs served by the commission. But the DCHA program is unique. It gives back to the community on so many different levels. Before you decide to cease funding of this program I urge you to reflect on all of the benefits the community will be losing if this program is lost.

Thank you,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Wednesday, August 19, 2009

Buyers are gaining leverage

Two months ago we looked at the percent of Dane County MLS listings under contract (i.e. the percent of listings with an accepted offer).

On June 20th, 22% of all single family home listings had an accepted offer. In other words for every one single family home listing under contract, another 3.5 listings were working for an accepted offer. As of August 18th, the percent of homes under contract dipped to 17%. For every home under contract, another 5 listings were working for an accepted offer. You'll see from the chart below the percent of homes under contract has dipped for most price categories. Homes priced under $225,000 tend to have a greater percentage of listings under contract. On June 20th, 11% of all condo listings had an accepted offer. In other words for every one condo listing under contract, another 8 listings were working for an accepted offer. As of August 18th, the percent of condos under contract dipped to 9% (for every condo under contract, another 10 listings were working for an accepted offer). Note from the table below the percent under contract is low across all price ranges, with the exception of condos priced under $150,000.

On June 20th, 11% of all condo listings had an accepted offer. In other words for every one condo listing under contract, another 8 listings were working for an accepted offer. As of August 18th, the percent of condos under contract dipped to 9% (for every condo under contract, another 10 listings were working for an accepted offer). Note from the table below the percent under contract is low across all price ranges, with the exception of condos priced under $150,000.

The numbers demonstrate the seasonality of the market and make it clear buyers are gaining leverage as we enter the fall season. We're seeing a lot of price reductions from sellers right now. In many cases, those sellers would have been wise to lower their prices earlier this spring or summer, when more buyers were out in the market.

For buying and selling tips, feel free to check out the buying real estate and selling real estate pages on DaneCountyMarket.com.

Have a good day,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Saturday, August 15, 2009

Dane County home sales up big in July

Dane County single family home sales jumped from 510 in July of 2008 to 595 last month - an increase of 17% - with homes priced under $250,000 selling very well. Sixty-seven percent of the homes that sold in July sold for under $250,000, compared to 56% last year. Thirty-eight percent of the homes that sold in July sold for under $200,000. The number last July was 29%.

July home prices were lower. The median single family home price decreased from $235,000 in July of 2008 to $220,000 in July 2009.

These numbers from the South Central Wisconsin MLS make it clear the first-time home buyer is driving the market. We're assisting several buyers right now who are working to find the right home before the first-time home buyer tax credit expires on December 1st. We won't be surprised if we see higher single family home sales for the next several months.

It's important to note the numbers above do not include condos. July condo sales remained light compared to last year. You'll find our full report on the month of July, including a separate breakdown of the condo market, at DaneCountyMarket.com.

Have a good weekend,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Tuesday, August 11, 2009

Housing starts up for the second straight month...

...but still low by historical standards. Dane County had 71 housing starts during the month of July, up 42% from the 50 housing starts from July of 2008. For more details, you can check out our full housing start report on the real estate trends page at DaneCountyMarket.com.

We will be reporting one other bit of encouraging news in the next few days. Dane County single family home sales were up noticeably in July. Our preliminary report on the month of July will be out next weekend.

Thanks to Dominic Collar from MTD Marketing Services of Wisconsin for sharing his housing start data. For more information about his statistics, feel free to contact Dominic directly at 920/993-8435.

Have a good day,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Saturday, August 8, 2009

Foreclosures set a record in July

Dane County and Wisconsin foreclosure filings reached new highs in July. For more info on the latest foreclosure trends, you can view our full foreclosure report on the economic trends page at DaneCountyMarket.com.

Have a good weekend,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Wednesday, August 5, 2009

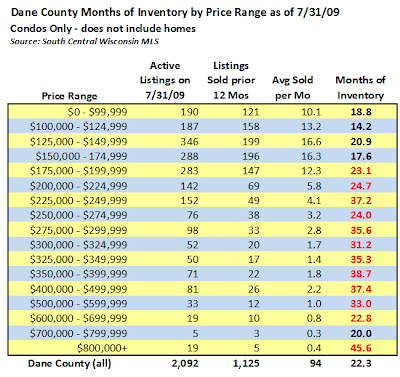

Inventories by price range

On July 31st we measured the months of inventory for Dane County homes and Dane County condos.

Inventories for homes priced below $225,000 were quite low. The first time home buyer tax credit has fueled a lot of demand for the starter home, and we continue to see many first-time home buyers who are looking to cash in on the credit by November 30th.

Have a good day,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Tuesday, August 4, 2009

It's a good time to invest

Prices for multifamily real estate have been decreasing, and there are some motivated sellers out there who are willing to sell at prices that make sense for the investor.

The first-time home buyer tax credit can also be used for multifamily real estate. We're assisting a client right now who's in the process of buying a duplex. He'll be occupying one unit, while the tenant in the other unit will be paying his mortgage. And, he'll be able to claim the credit. Not bad.

You'll find our full report on the multi-family market on the economic trends page at DaneCountyMarket.com.

Have a good day,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com

Saturday, August 1, 2009

Are we there yet?

A lot of people are writing and talking about the housing bottom these days. "Are we there yet?" is a question we hear a lot.

If we define the bottom in the housing market as the point at which both sales and prices begin to increase, then we haven't reached bottom. Sales are decreasing on a year-over-year basis, although the encouraging news is that the decrease appears to be slowing.

Prices also continue to decrease, and are likely to be under pressure for as long as we continue to see foreclosures on the rise. (July was a record month for Dane County foreclosures. We'll be sharing the July numbers in the next few days.)

Of course it's really not fair to paint a broad brush across the whole market. Some price ranges and locations are likely to rebound before others, while the single family home market is likely to bounce before the condo market.

Then there are the wild cards such as the $8,000 first-time home buyer tax credit that can have a huge impact on market dynamics. Don't be surprised if we see another housing stimulus plan appear in the coming months - one which will change all that we know about the market right now.

And last, don't forget about mortgage rates. A big shift in rates can have a big impact on the market.

Given all of the fuzziness and murkiness around the subject of the housing bottom, this will be our first and only post on this topic. We're not economists, but we'll continue to share the data and trends to help you shape your own opinions.

Have a good weekend,

Dan Miller, Keller Williams Realty and DaneCountyMarket.com