Researching a mortgage is one very good way you or your buyer agent can learn about a seller's position prior to making your offer. Another very useful research exercise you can undertake is to look at whether or not the seller has fallen behind on his property tax payments. Why is this important? Because a seller will need to pay off any delinquent taxes by the time of closing before the property can change hands.

Checking for delinquent taxes is easy to do and takes only a few minutes of time. Here's how you do it:

- Go to Access Dane.

- Select Public Access.

- Select Parcel Information.

- Select Query by Parcel Address.

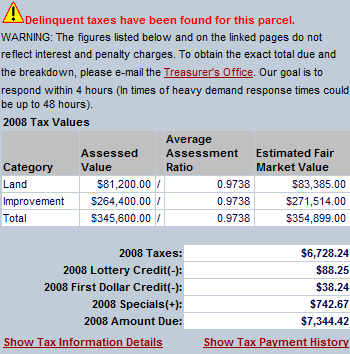

- Enter the Address Number and Street Name and click Search. A property information page will appear, including a section on taxes that looks like this:

Note Access Dane has flagged the above property as having delinquent property taxes. To find out how much the seller owes in back taxes (including penalties and interest), all you or your buyer agent need to do is send an email to the Treasurer's Office. The Treasurer's Office will return your email with an itemization of how much the seller owes in back taxes, penalties and interest. More great information to have as you prepare for your offer.

There are many more ways that you can research a property prior to making your offer. For more information, you find these articles on the DaneCountyMarket buying real estate page useful:

No comments:

Post a Comment